How much does Shopify take per sale? If you’re running an online store on Shopify, it’s important to understand the fees involved.

Shopify charges different transaction fees depending on the plan you choose, with rates ranging from 2.9% + $0.30 to as low as 2.15% + $0.30 for higher-tier plans.

You can also reduce costs by using Shopify Payments, which helps avoid extra fees from third-party payment processors. Understanding these fees is key to managing your business expenses effectively.

Let’s get into all the details now.

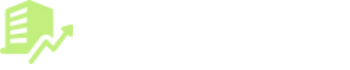

Shopify Plans Comparison (2025)

| Plan | Price | Credit Card Rates (Online) | Credit Card Rates (In-person) | Online International/AMEX Credit Card Rates | Transaction Fees (For Third-party Processors |

| Starter | $5/month | 5.0% + $0.30 | N/A | N/A | 5.0% |

| Basic | $39/month | 2.9% + $0.30 | 2.7% | 3.9% + $0.30 | 2.0% |

| Grow | $105/month | 2.6% + $0.30 | 2.5% | 3.6% + $0.30 | 1.0% |

| Advanced | $399/month | 2.4% + $0.30 | 2.4% | 3.4% + $0.30 | 0.5% |

| Shopify Plus | $2000/month | 2.15% + $0.30 | 2.15% | 1.0% | 0.15% |

Does Shopify Take a Cut From Your Sales?

The answer is Yes. Shopify does take a transaction fee on each sale of your products. The cut is not very high, though.

When calculating your overall cost of using Shopify, it’s important to factor in not just transaction fees but also potential savings from promotional offers. One common question among new sellers is the 3-month trial still available? Depending on Shopify’s current campaigns, this trial can help you test the platform at a minimal upfront cost and better understand your expenses before committing long-term.

Luckily, you don’t have to pay these charges upfront. It automatically deducts after a successful sale. And the higher the plan you choose, the lower the percentage you will have to pay. That’s why choosing the right plan for your store is necessary.

How Much Does It Cost To Sell On Shopify?

Shopify imposes a fixed percentage as a payment processing fee. With Shopify, you can accept payments in multiple ways. However, for every payment method, the processing fee is different. So what fee Shopify deducts will depend on your customer’s payment method. Let’s see the types of payment methods and their processing fee.

Credit Cards (For Online Payments) – 2.15%~5.0% + $0.30

Shoppers mostly use credit cards to pay their online bills. Similarly, they use cards to purchase something online. Shopify also supports many types of credit cards, such as Mastercard, Discover, and Visa. You can set up your preferred credit cards to accept payments from shoppers.

If shoppers use credit cards to purchase something from your store, Shopify imposes a percentage of each sale and an additional 30 cents as a processing fee. The processing rates mainly depend on the Shopify plan you choose.

Credit Cards (For In-Store Payments) – 2.15%~2.7%

Shopify offers a POS (point of sale) feature that allows sellers to sell in both online and physical stores. With this feature, sellers can manage both their online and in-person stores under one Shopify account. Shoppers can use credit cards to purchase from physical stores too.

For in-store purchases, the payment processing fee for credit cards is the same as for online stores. But you don’t have to pay an additional 30 cents.

International And AMEX Credit Cards – 3.4%~3.9% + $0.30

You can also accept international credit cards and AMEX (American Express) Cards as payment. However, the payment processing fees for these cards are slightly higher than regular credit cards. The processing follows the same method as regular cards. For in-store payments, Shopify takes a fixed percentage, while for online payments, they impose an additional 30 cents.

Third-Party Payment Processors – 0.15%~5.0%

Shopify supports more than 120 third-party payment gateways, including various EMI, UPI, Pay Later methods, and e-wallets. You can set your preferred third-party processors to accept payments from shoppers. The processing fee for these third-party payment processors is slightly low compared to credit cards, except for the Starter plan users. The transaction cost for third-party payment gateways varies according to the Shopify plan you choose.

Shopify Pricing Plans and Selling Costs

Shopify is a great platform to start an eCommerce business. Whether it is a small or enterprise-level company, Shopify caters to every business size. That’s why they offer a tier-based pricing structure so sellers can easily start online businesses regardless of their size of business. Transaction fees also vary according to the Shopify plans. Currently, they are offering five plans to their users.

1. Starter – $5/month

The Starter plan is for merchants and influencers who want to sell products through messaging apps or social media platforms. However, the plan is not suitable for those who want to create a standalone website for their business. As soon as you sign up for this plan, you can link your social profiles and use eCommerce features.

- Credit Card Fees (For Online Payments): 5.0% + $0.30

- Transaction Fees for Third-party Payment Processors: 5.0%

2. Basic – $39/month

Shopify’s Basic plan lets you create a standalone website for your business. With this plan, you will get all the features you need to run an online store. You can add and sell unlimited products with this plan. You can also sell in physical stores and manage activities in your Shopify account.

- Credit Card Fees (Online Stores): 2.9% + $0.30

- Credit Card Fees (Physical Stores): 2.7%

- Online International/AMEX Credit Card Rates: 3.9% + $0.30

- Transaction Fees for Third-party Payment Processors: 2.0%

3. Grow – $105/month

If your small or medium-sized business is measuring new heights, the Shopify plan will be the best option for you. The plan offers a few advanced features and increased access to tools. You can upgrade your current plan to Shopify from your admin dashboard.

- Credit Card Fees (Online Stores): 2.6% + $0.30

- Credit Card Fees (Physical Stores): 2.5%

- Online International/AMEX Credit Card Rates: 3.6% + $0.30

- Transaction Fees for Third-party Payment Processors: 1.0%

4. Advanced – $399/month

Shopify’s Advanced plan is great for large or medium-sized businesses that are growing rapidly. The plan offers sophisticated features such as advanced reporting, lower transaction fees, and abandoned cart recovery.

- Credit Card Fees (Online Stores): 2.4% + $0.30

- Credit Card Fees (Physical Stores): 2.4%

- Online International/AMEX Credit Card Rates: 3.4% + $0.30

- Transaction Fees for Third-party Payment Processors: 0.5%

5. Shopify Plus – Starting from $2000/month

It is Shopify’s enterprise-level plan that caters to large businesses and industries. It offers custom solutions for businesses. The basic pricing starts from 2K a month. The base will increase if you want more additional features. With Shopify Plus, you will get personalized solutions that will help you increase conversion and sales.

- Credit Card Fees (Online Stores): 2.15% + $0.30

- Credit Card Fees (Physical Stores): 2.15%

- Online International/AMEX Credit Card Rates: 1.0%

- Transaction Fees for Third-party Payment Processor: 0.15%

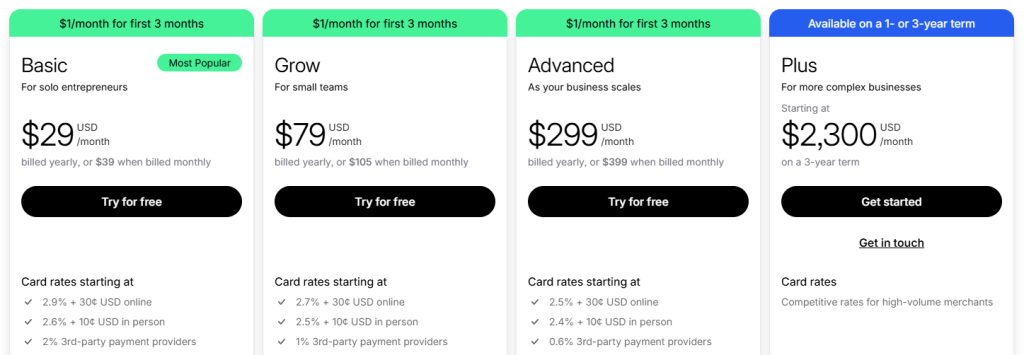

Shopify 90-day Trial Offer

Shopify is currently running a 90-day trial offer at just $1/month. This offer is exclusively available for all the new users of Shopify. First, they need to sign up for a 3-day free trial after that, they need to fill out their financial information to access the 90-day trial offer. The best part about this offer is that you can use the features of any plan.

During this trial offer, you can properly create your online store, add products, and start selling in no time. Once this trial is over, you will have to pay for the plan you have chosen. If you are not happy with the services of Shopify, then you can either pause your account or cancel it.

Use Shopify Payments

Shopify Payments is an in-house payment provider of Shopify. It directly integrates with your checkout. The major benefit of using Shopify Payments is that you don’t have to pay any transaction fee for selling products in your store.

You can add payment methods such as credit cards, PayPal, Amazon Pay, cryptocurrency, and gift cards. However, Shopify Payments is only available in certain countries and regions, so check whether it is available in your region.

How To Choose The Right Shopify Plan?

Here are some tips for choosing the right Shopify plan for your business needs:

- Consider your monthly order volume, as higher tiers offer more transactions and lower rates.

- Do you need POS capabilities for in-person sales? Shopify and Advanced Shopify include POS.

- Will you have enough products to necessitate bulk discounts? Advanced Shopify+ enables discounts.

- Do you plan to have multiple user accounts? More staff seats come with Advanced and Shopify Plus.

- Need advanced reporting on customers and channels? Shopify Plus has expanded reporting.

- Are you setting up multiple stores? Shopify Plus allows unlimited stores.

- Will API customization be required? Shopify Plus offers more customization abilities.

- Do your peak sales warrant the volume discounts of Plus? Shopify Plus reduces rates over $800K+ in sales.

A good approach is starting with lower tiers, Shopify Basic or Shopify, and scaling up over time as order volume increases. Examine the rates table and feature differences carefully when deciding.

Related Read:

Summary: Shopify Only Charges For Processing The Payments

Hopefully, now you have a better idea of Shopify’s pricing structures and the fees that occur after each sale. It is a service cost that Shopify imposes to cover payment processor integration. However, it varies for every Shopify plan. If you are a member of a premium tiered plan, the transaction fees will be less than inexpensive plans.

If you want to avoid these transactions and processing fees, you can use Shopify Payments as your payment provider. It supports almost all payment processors and third-party providers, so you can set it to your account without much effort.

FAQs

Shopify takes a transaction fee of 2.9% + $0.30 for online orders and 2.7% for in-person transactions with Shopify POS. There are no other fees per sale.

No, Shopify requires a paid subscription plan. The basic Shopify plan starts at $39/month. There is no completely free Shopify plan. However, Shopify is currently offering 90 days offer where you can get access to any plan at just $1/month.

Shopify Plus is worth considering once a store is seeing over $1 million in annual sales. Shopify Plus offers more advanced features, customization, scalability, and dedicated support for high-volume merchants.

Shopify payments are deposited directly into a seller’s bank account on a bi-weekly or monthly cadence. Payout timeframes depend on the payment method and account status.

Benefits include easy setup, customizable themes, secure hosting, integrated payment processing, shipping discounts, marketing tools, app integration, and responsive support.

- Shopify 3 Months For $1 (DEC 2025) – 90 Days Trial - October 3, 2025

- Helium 10 Free Trial (2025) — Access Premium Features - September 4, 2025

- Jungle Scout Free Trial (2025) — Get 7 Days Access Now - September 4, 2025